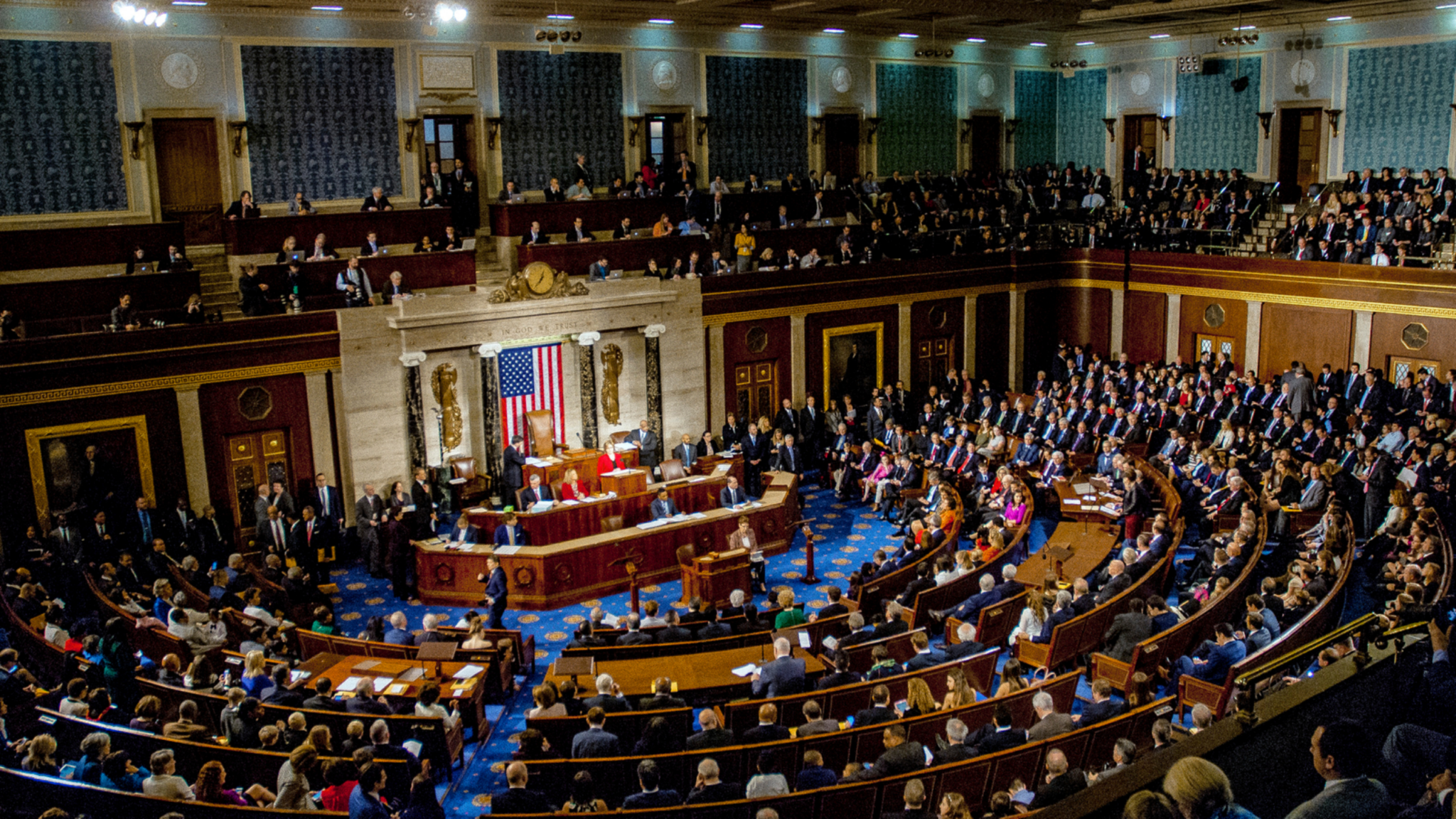

In the dynamic arena of U.S. politics, the topic of cryptocurrency has emerged as a significant point of discussion among the nation’s lawmakers. The latest insights reveal a notable divergence in opinions among U.S. senators, with a group showing clear support for digital assets, while others express reservations or outright opposition.

A recent analysis by Stand with Crypto, a non-profit advocacy group, sheds light on the current sentiment within the U.S. Senate. Surprisingly, at least 18 senators have voiced support for cryptocurrencies, signaling a growing interest in this innovative financial sector. However, on the other side of the spectrum, 30 senators have taken a stand against crypto, highlighting the complexity of this issue in the political landscape.

Leading the pro-crypto charge are Republican senators Cynthia Lummis and Ted Burr. Senator Lummis, known for her active involvement, has introduced eight crypto-related bills and made 184 public statements on the subject. Similarly, Senator Burr has been vocal with eight bills and 24 statements advocating for the integration of cryptocurrency in the U.S. financial system.

Senators Ted Cruz and Bill Hagerty, also Republicans, have been closely aligned with Lummis and Burr. Their collective efforts include presenting five bills and making 92 statements in favor of cryptocurrencies. Interestingly, of the 18 senators showing support, 14 are from the Republican party, while only four are Democrats, indicating a possible partisan tilt in the approach towards digital assets.

On the flip side, the opposition camp comprises 30 senators, with a majority of 23 Democrats, five Republicans, and two Independents. This group’s stance underscores the concerns and challenges perceived in integrating cryptocurrencies into the mainstream financial framework.

The presidential race also reflects this divide. Donald Trump, a Republican candidate, and independent candidate Robert F. Kennedy Jr. have shown inclinations towards supporting cryptocurrency. Kennedy has even made Bitcoin a central theme of his campaign, proposing potential legislation. However, President Joe Biden seems to lean against crypto, with public statements indicating a cautious or negative view towards digital currencies.

A focal point in the anti-crypto movement is Senator Elizabeth Warren. She has been a vocal critic, backing or introducing three bills against cryptocurrencies and issuing 76 statements against digital assets. Her significant move in July 2023, with the reintroduction of the Digital Asset Anti-Money Laundering Act, highlights her commitment to regulating this space. This act, co-introduced with Senators Joe Manchin, Roger Marshall, and Lindsey Graham, aims to tighten controls over noncustodial digital wallets and extend anti-money laundering measures.

Senator Warren’s bill has garnered support from a bipartisan coalition, including nine senators from both the Democratic Party and an independent senator. This support from high-ranking committee chairs like Gary Peters and Dick Durbin emphasizes the seriousness with which these regulatory efforts are being taken.

However, the bill has not been without criticism. Advocacy groups have raised concerns about its efficacy in addressing the illicit use of digital assets. Senator Warren’s “war on crypto” theme in her reelection campaign and her statements linking cryptocurrencies to financing terrorism and other illicit activities have sparked debate, especially in light of emerging evidence suggesting a more nuanced reality.

Moreover, the House is also actively involved, with a draft released in June aiming to limit the SEC’s authority over crypto firms and proposing the Federal Reserve as the main regulator for stablecoins.

As the U.S. Senate navigates the complexities of cryptocurrency, it’s clear that this topic will remain a significant and divisive issue. The varied perspectives among senators underscore the challenges in creating a regulatory framework that balances innovation with consumer protection and financial stability. This ongoing debate in the Senate not only reflects the rapidly evolving landscape of digital assets but also highlights the critical role of bipartisan cooperation in shaping the future of cryptocurrency regulation in the United States.