Key Takeaways

- Crypto lobbying efforts persist despite setbacks.

- Crypto ownership is more widespread than previously thought.

- Politicians may not prioritize crypto due to limited large-scale investment.

A few years back, crypto companies were at the forefront of Super Bowl advertisements, signaling a potential shift toward widespread acceptance of cryptocurrencies as common investment options. As we all know – this hasn’t succeeded then.

Nevertheless, there’s always room for optimism. Controversial sectors targeted by Washington’s scrutiny have a reliable strategy: persuading politicians that the industry matters greatly to voters, who will retaliate against legislators perceived as hostile by voting them out of office.

Crypto Lobbying Power Persists Despite FTX Founder’s Fall

During the aforementioned period, Sam Bankman-Fried, the founder of FTX, emerged as one of the largest political contributors in the United States. However, his subsequent indictment and conviction for fraud did not significantly deter the industry’s efforts to influence policy and perception in Washington.

According to the Center for Responsive Politics , the cryptocurrency industry set a new record by spending $24.5 million on lobbying activities last year, demonstrating its continued commitment to securing a favorable regulatory environment and public opinion, despite facing setbacks and scrutiny.

Despite the significant strides made by the cryptocurrency industry in terms of lobbying efforts and visibility, it continues to face skepticism and resistance from certain political figures and regulators. Notably, figures such as Senator Elizabeth Warren from Massachusetts and Gary Gensler, the Chairman of the Securities and Exchange Commission (SEC), have maintained a critical stance towards cryptocurrencies.

This ongoing scrutiny underscores the complex relationship between the crypto sector and regulatory bodies. Even as Bitcoin experiences a surge in value, the attitude of key policymakers and regulators in Washington towards virtual currencies remains largely unchanged.

This was highlighted recently when CCN reported that the SEC intensified its regulatory actions against Ether, the world’s second-largest cryptocurrency, signaling the ongoing challenges and regulatory pressures facing the crypto industry.

From ‘Web 3.0 Voters’ to Widespread Ownership

In the spring of 2022, seasoned political strategist Chris Lehane , who was representing a cryptocurrency investment firm, publicized a survey he had initiated to promote the notion that “Web 3.0 voters,” a term he coined, would play a decisive role in the upcoming midterm elections, likening them to a modern equivalent of the influential “soccer moms” demographic. I remained skeptical of this assertion.

Since then, the situation for the cryptocurrency sector has deteriorated, with the conviction of Sam Bankman-Fried being a notable contributing factor. Despite these challenges, the idea that voters with an interest in cryptocurrency form a significant demographic that political candidates should engage with persists. A recent poll of 1,000 registered voters, conducted by Paradigm , a cryptocurrency investment firm, represents the latest effort to advocate for this perspective.

The survey reveals that nearly one in five voters (19%) have purchased cryptocurrency, with a surprisingly even distribution among Democrats (19%), Republicans (18%), and independents (24%). It’s less unexpected to find that young men (41%) are the most probable demographic to own cryptocurrency.

Additionally, one-third of African Americans and 32% of Hispanics reported owning or using cryptocurrency, marking a significant increase from the previous year’s figures of 20% and 22%, respectively.

Crypto Boosted by ETFs, But Politicians May Not Feel the Heat (Yet)

Part of the uptick in cryptocurrency engagement can likely be attributed to a notable development in crypto policy: the SEC’s authorization in January to allow spot Bitcoin ETFs, which have since drawn billions of dollars in investments.

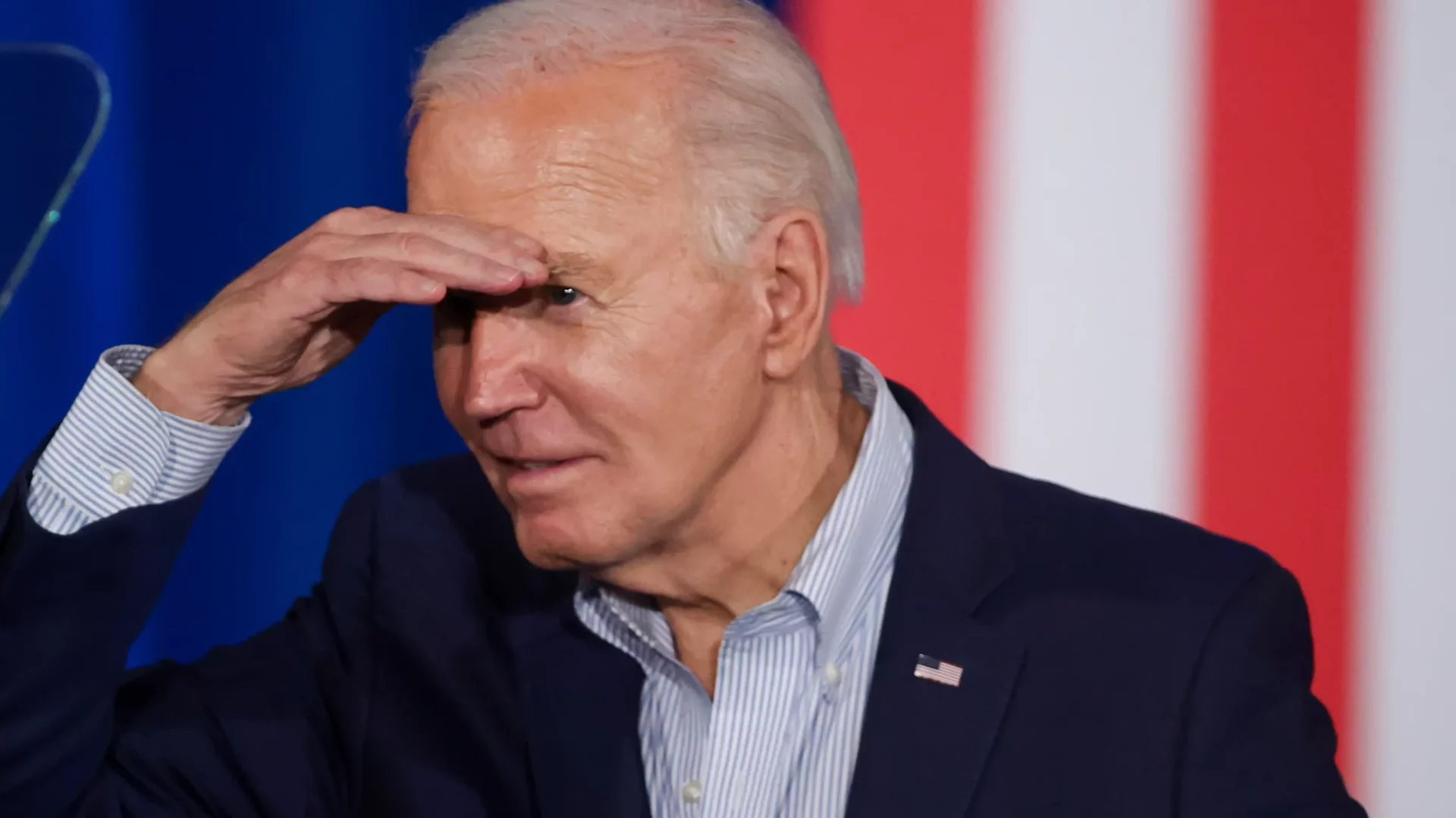

Moreover, the poll indicates a political preference among cryptocurrency owners, possibly influenced by the Biden administration’s lukewarm stance towards the sector, showing a preference for Trump over Biden, 48% to 39%. This suggests that Biden and other politicians skeptical of cryptocurrency need to align more closely with the sector’s interests.

However, the survey also highlights a potential reason why politicians might not feel urgently pressed to cater to the crypto market. Only 1% of voters report owning over $10,000 in cryptocurrency, suggesting that while interest in crypto is widespread, substantial investments within the voter base remain limited.

Was this Article helpful?