Easily one of the most talked-about investments on Wall Street is Marathon Digital MARA. Specializing in blockchain mining – particularly the benchmark cryptocurrency – MARA stock has been in the spotlight thanks to the stratospheric run of the underlying sector. While the company recently released its earnings report, the real story has been the projected trajectory of major blockchain assets.

Despite the rabid enthusiasm for virtual currencies, the sector also provided some pause for thought. On Thursday, MARA stock tanked despite the underlying company generating revenue of $156.7 million, handily beating analysts’ consensus target by $11.27 million. High short interest combined with some cold feet regarding the crypto market’s mercurial run likely contributed to the fallout.

Obviously, the volatility raises the question: should investors continue to trust cryptos and by logical deduction MARA stock? Or will the bears finally take control of the decentralized ecosystem? To better answer this inquiry, investors need hard data – and that’s where Barchart’s premium subscription service comes into play.

Identifying the Smart Money Trades

As with any other investment, a valuable piece of intelligence comes from understanding what the smart money is doing. It’s one thing to trade on your Uncle Bob’s advice; it’s quite another to monitor major transactions. The latter indicates the potential of institutional money positioning itself, which is crucial for determining forward probabilities.

Here, Barchart’s options flow screener represents an invaluable resource. Unlike other screeners, the options flow specifically targets big block trades and nothing else. Did your friend buy one call option for MARA stock? Great – that’s not going to show in options flow. On the other hand, if a hedge fund bought 3,000 near-expiry calls, Barchart will pick up that data.

For free users, they will have access to the first three transactions. For a hot security like MARA stock, that’s absolutely nothing. Following the close of Thursday’s session, Barchart gave me 100 lines of options flow data. Downloadable as an Excel file, I can filter and arrange the data as needed to determine areas of downside risk along with upside targets.

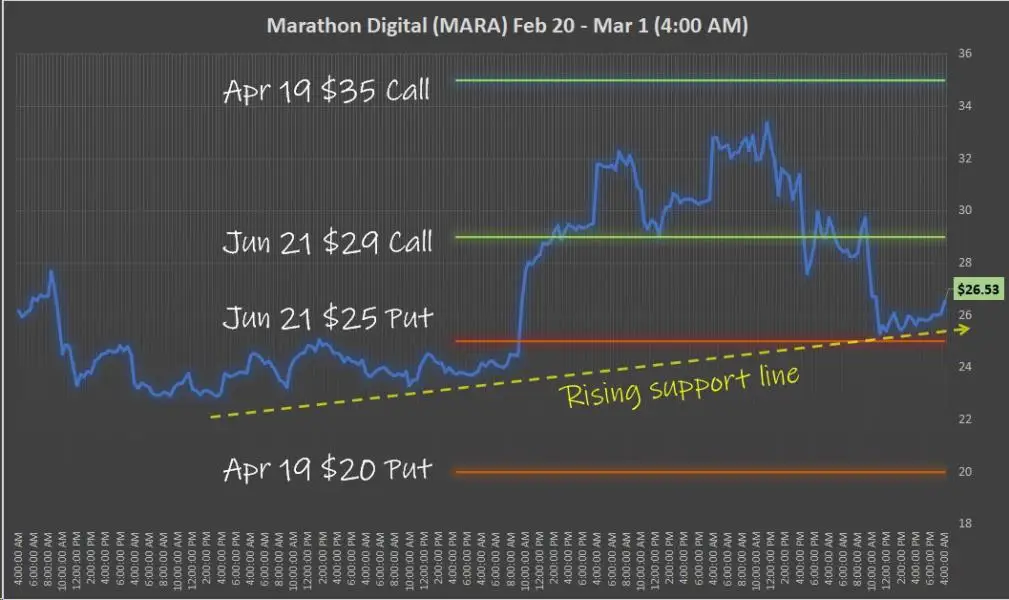

Based on the variance of volume relative to prior open interest, I identified four options that appeared intriguing:

- 1,796 contracts of the APR 19 ’24 20.00 Put

- 2,066 contracts of the JUN 21 ’24 25.00 Put

- 1,377 contracts of the JUN 21 ’24 29.00 Call

- 1,594 contracts of the APR 19 ’24 35.00 Call

Essentially, the two put options represent not only downside risk levels but also volatility “insurance.” It’s quite possible that the major traders were buying these puts to protect themselves in case of significant downside. On the flipside, the calls represent upside targets. Here, we can reasonably assume that traders are hoping MARA stock reaches the associated strike prices before expiration.

Looking ahead, you can pencil in these strike price levels as zones of risk and opportunity. That’s what the smart money sees objectively, providing some measure of confidence.

Rolling Out the Big Guns

Every premium service has a marquee function that users gravitate toward. In my humble opinion, for Barchart, that may very well be its extensive intra-day historical data access. Here, you can drill down to one-minute intervals – seriously, that’s no joke.

It’s a gamechanger for anyone interested in taking their trading to the next level.

Using MARA stock as an example, I ran a historical data search going back to Feb. 20 using 30-minute intervals. Downloading the data as an Excel file and subsequently charting the information, I also juxtaposed the aforementioned options flow transactions. The results are quite insightful:

Primarily, the $25 put represents a possible line in the sand. The big dogs likely placed their insurance bets here for a reason. Maybe they felt this was where demand would outstrip supply. Whatever the hypothesis, it’s working. As of the very early pre-market session of March 1, MARA stock is rising above the implied support line.

Also, thanks to the intraday chart, Barchart’s premium users are able to discern a rising support line that has acted as a backstop amid MARA’s recent volatility. Go look at other financial publication resources – it’s difficult to pick out this line.

Such knowledge gives you the confidence that MARA stock may have the ability to bounce higher rather than succumb to a new wave of bearish pressure. Stated differently, without Barchart’s premium service, you’re effectively trading blind.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.