Orbs is collaborating with OTC derivatives platform, SYMMIO, for seamless on-chain derivatives trading. Under the partnership, the two will work on promoting capital efficiency while tapping into deep liquidity.

The partnership comes amid the growing demand for the layer 3 blockchain technology offered by Orbs. Its Liquidity Hub, tailored towards DEXs, is also addressing the issue of liquidity fragmentation in decentralized finance (DeFi).

Copy link to section

By working with SYMMIO, Orbs hopes to promote efficient capital deployment for derivatives traders. The two will work on a wide range of use cases around the onchain derivatives market by using the existing layer three technology offered by Orbs.

Among the offerings being promoted under the deal is an on/offchain communication oracle. They will also work on a bidding system targeting hedgers to lower risk while leveraging the benefits presented by derivatives trading.

Derivatives currently comprise a huge part of crypto trading volumes on centralized exchanges. However, spot trading is dominant on-chain, with only $2 billion of the $60 billion DeFi total value locked (TVL) coming from derivatives.

Looking to invest?

Invest globally in stocks, options, futures, currencies, bonds and funds from a single unified platform, with our highest-rated broker.

Interactive Brokers (U.K.) Limited is authorised and regulated by the Financial Conduct Authority. FCA Register Entry Number 208159. Products are only covered by the UK FSCS in limited circumstances.

Ad

Orbs and SYMMIO want to address this imbalance. The two will support onchain traders in opening leveraged positions. They will also help traders use their capital efficiently while hedging against downside risk.

Are you looking for fast-news, hot-tips and market analysis?

Sign-up for the Invezz newsletter, today.

Boosting onchain trading for derivatives

Copy link to section

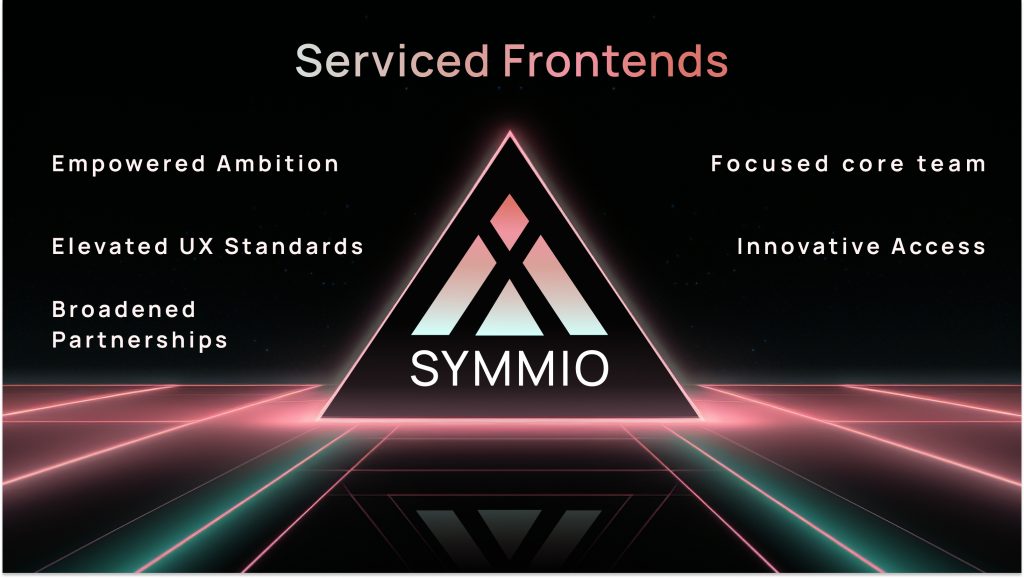

SYMMIO is transforming bilateral OTC derivatives by merging them with intent-based execution. It offers ample liquidity and novel architecture to support the issuance and trading of trustless and permissionless derivatives between parties.

SYMMIO wants to continue dominating crypto derivatives by addressing the issue of limited onchain liquidity. Those planning to open a position on the SYMM-powered front end will have quotes streamed by different hedgers.

The solution that SYMMIO is promoting mandates the front end to pick the best quote depending on user parameters to create onchain intent before a trade is executed on-chain. The parties involved in the trade need to lock collateral.

The solution promoted by SYMMIO will bring liquidity to the derivatives market. It will ensure that hedgers can tap external liquidity from available sources like centralized exchanges like Binance.

The solution will improve liquidity for SYMMIO’s derivatives offerings compared to the other derivatives platforms. It will also improve capital efficiency. By working with SYMMIO, Orbs will increase the adoption of the innovative technology while also making it safer for traders to secure exposure to onchain derivatives.

Ad

Learn to trade crypto easily by copying crypto signals & charts from pro-trader Lisa N Edwards. Sign-up today for easy-to-follow trades for tonnes of altcoins at GSIC.