Sam Bankman-Fried apologized for wrecking the lives of FTX customers while still trying to shift the blame for their losses

Angle down icon

An icon in the shape of an angle pointing down.

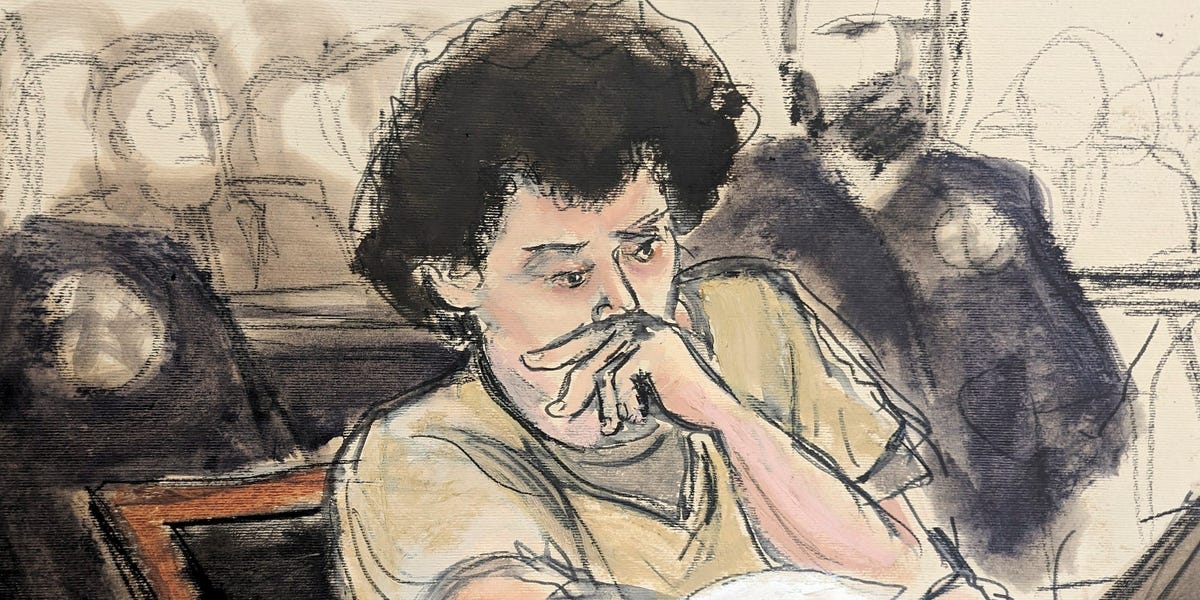

Elizabeth Williams via AP

- Sam Bankman-Fried was sentenced Thursday to 25 years in prison.

- Ahead of the sentencing, the fallen crypto king admitted that he “failed” and apologized.

- He expressed remorse for his former colleagues at his now-bankrupt cryptocurrency exchange FTX.

Fallen cryptocurrency king Sam Bankman-Fried spoke out Thursday in a Manhattan federal courtroom ahead of being sentenced to 25 years behind bars, apologizing to FTX customers who had lost their life savings and the employees who had followed him “across the Earth” before he let them down.

“They all held something really beautiful,” Bankman-Fried said, referring to the fallen cryptocurrency exchange. “They threw themselves into it, and I threw it all away. It haunts me every day.”

Bankman-Fried appeared more subdued than he did during his trial in October. He spoke cautiously, pausing occasionally as he addressed US District Judge Lewis Kaplan.

“My useful life is probably over. It’s probably been over for a while now, from before my arrest,” Bankman-Fried said.

Prior to making his statements, Bankman-Fried listened to impact statements from two people – former FTX customer Sunil Kavuri and Adam M. Moskowitz, an attorney involved in a class action case against Bankman-Fried and other former executives.

“I lived the FTX nightmare every day for two years,” Kavuri said.

Moskowitz, meanwhile, asked the judge to consider Bankman-Fried’s cooperation in the recovery case.

The 32-year-old cofounder of the now-bankrupt cryptocurrency exchange FTX was found guilty on seven counts of wire fraud, money laundering, and conspiracy charges in November after a six-week criminal trial.

“I failed everyone I care about and everything I cared about,” Bankman-Fried told the court before Kaplan sentenced him for what prosecutors described as one of the biggest financial frauds in US history.

Bankman-Fried said his colleagues “watched me throw away everything they had built.”

“They were very let down. I’m sorry about that. I’m sorry about what happened at every stage,” he said.

He added that his pain is less important than that of customers and creditors, noting that it has been “excruciating to watch all of this unfold in slow motion.”

Even so, he said he did not think the story of why customers suffered “has been told or told correctly.”

He again tried to shift the blame for how and why the crypto exchange collapsed, insisting that there are “enough assets” to make customers whole. His attorneys argued that customers suffered “zero” losses.

Customers “could have been paid back” at 2022 prices or current prices, including inflation, Bankman-Fried claimed.

“I’m hopeful and optimistic that that’s finally going to happen,” Bankman-Fried said. “They deserve that… There are enough assets for that. There always have been.”

Kaplan didn’t buy the argument, calling it “speculative” and “misleading.”

He went on to enumerate three instances where Bankman-Fried perjured himself on the stand: when Bankman-Fried said he didn’t know his company was spending FTX customer funds; when he said he didn’t know about the $8 billion liability in the company’s balance sheets; and when he claimed not to have known that repaying customers would require borrowing additional funds.

That list was not exhaustive, Kaplan said, adding that it would not be a “good use of time to articulate” all of Bankman-Fried’s lies on the stand. Bankman-Fried admitted to making mistakes but didn’t show remorse, Kaplan said.

Before handing down Bankman-Fried sentence, Kaplan said he wanted to prevent him from committing more harm, noting that he has previously marketed himself to the media to rebrand his image and version of events at FTX.

“There is a risk that this man will be in a position to do something very bad in the future, and it’s not a trivial risk, not a trivial risk at all,” the judge said, noting that the judgment had to “reflect the seriousness of the crime.”

Kaplan said that the sentence would be “for the purpose of disabling” Bankman-Fried “to the extent that can appropriately be done for a significant period of time.”

Bankman-Fried faced a maximum of 110 years in prison following the collapse of FTX. Prosecutors had asked for a sentence between 40 and 50 years behind bars, comparing him to the notorious late Wall Street Ponzi schemer Bernie Madoff.

Damian Williams, the US attorney for the Southern District of New York, said in a statement after the sentencing that Bankman-Fried “orchestrated one of the largest financial frauds in history, stealing over $8 billion of his customers’ money.”

“His deliberate and ongoing lies demonstrated a brazen disregard for his customers’ expectations and disrespect for the rule of law, all so that he could secretly use his customers’ money to expand his own power and influence,” Williams said.

The sentence given to Bankman-Fried will prevent him from “ever again committing fraud” and also sends an “important message to others who might be tempted to engage in financial crimes that justice will be swift, and the consequences will be severe,” said Williams.

This story has been updated.