News

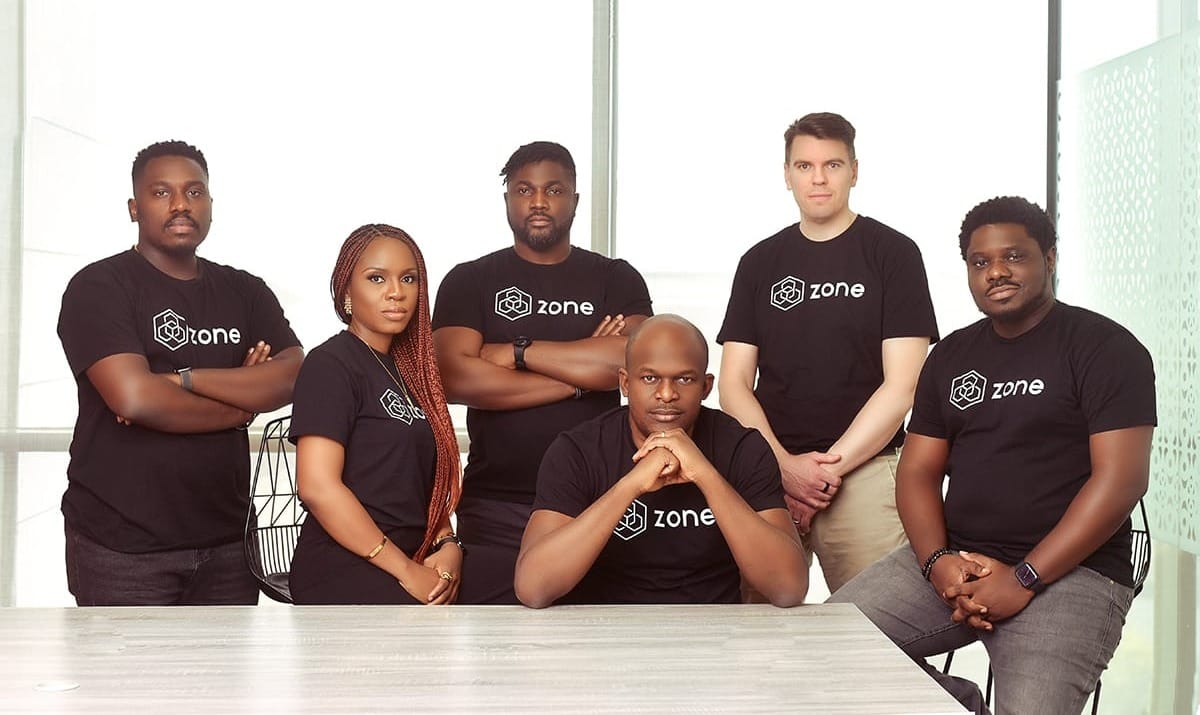

Zone, a Nigerian blockchain fintech has secured $8.5 million in a seed round led by Flourish Ventures and TLcom Capital.

Sub-Saharan Africa faces the burden of the world’s highest remittance costs. Sending just $200 to the region has become even more expensive, with the World Bank reporting a rise in average cost from 7.2% in Q2 2022 to 7.9% in Q2 2023.

In a bid to revolutionise this landscape, Appzone Group, a former fintech software provider, made a pivot with the launch of Zone and Qore, its Banking-as-a-Service business which was also carved into a separate standalone company in 2022.

“With this transition to Zone, we are utilising the power of blockchain technology to connect every monetary store of value and enable reliable, frictionless and universally interoperable payments. In doing this we are building one global network to pay anyone through any means, in any currency, which will ultimately maximise financial inclusion and accelerate economic prosperity for Africa and the rest of the world,” Obi Emetarom, Zone’s co-founder and CEO, said at the time.

Zone is a regulated blockchain network designed to streamline digital currency transactions and acceptance. The solution leverages Africa’s first Layer-1 blockchain network, facilitating direct transactions between financial institutions; it came with a promise to slash transaction costs, enable instant dispute resolution, and bring reliability to payments across Africa and beyond.

The innovation is already gaining traction—over 15 African banks and fintech startups including Access Bank Plc, Guaranty Trust Bank Plc, and United Bank of Africa have already been onboarded on Zone. To further accelerate growth, Zone recently secured $8.5 million in an oversubscribed seed funding round led by Flourish Ventures and TLcom Capital.

Renowned blockchain VC firms like Digital Currency Group, Verod-Kepple Africa Ventures and Alter Global also participated in the round.

“The startup was funded initially by the parent company. When you separate the traditional business, the natural thing to do is to raise money to continue growth,” Emetarom said.

This funding will fuel Zone’s expansion plans. Firstly, it will expand domestic coverage, onboarding more banks and financial service companies. Secondly, a significant portion will be directed towards a crucial pilot program in 2025, testing Zone’s capabilities for seamless cross-border transactions. Zone’s vision is clear: to become a global payment network.

“For the first time in Africa, Zone’s technology enables direct communication between participants in the payment ecosystem,” said Ameya Upadhyay, Partner at Flourish Ventures. “We believe this is a fundamental leap that will allow customers to experience a completely new standard of reliability, speed and cost efficiency at the ATM, at POS machines and online.”

In 2022, the Central Bank of Nigeria granted Zone a payment switching and processing licence. This empowers Zone to expand its existing transaction switching and processing services offered to banks and fintechs through its blockchain network.