Cryptocurrency miners have their sights set on Texas due to competitive energy costs, tax subsidies, incentive programs and some city leaders who are favorable to their operations though they may not fully understand them.

“I don’t understand the bitcoin either, but what I do understand is the need for high-speed computing. And that never goes away,” Mayor Gerard Hudspeth said at Denton City Council’s work session Tuesday. “And so that is where I’m comfortable beyond just the crypto use is if ever there is a situation … the list of people who can use high-speed computers that have power forms to the left.”

Bill Shepherd, DME’s executive manager of business services, told Hudspeth and council members that in 2022, a “multitude” of cryptocurrency miners approached Denton Municipal Electric, all wanting practically the same thing: to locate next to DME’s substation, to consume about 20 megawatts of power and to be on city property.

For about a year, Shepherd said, DME has been negotiating with the top prospect among those crypto miners to build a small data center on 2 acres in the airport industrial park on the outskirts of town.

The data center, which will be a modular setup, will be mining bitcoin and would generate about $2.5 million in income to DME and $4.5 million in revenue to the city over five years.

“Now we’re at a point where they are going to have to start spending some substantial money, which is why I’m bringing this to you a little earlier without having some physical documentation,” Shepherd said.

Denton Municipal Electric

Shepherd was seeking council direction for two options. The first option would be to move forward, start working with development services and approve a five-year lease — with a five-year renewal option — and a power purchase agreement. The second option would be to deny moving forward.

A council majority gave direction to move forward with the new data center project.

“I expect as soon as this meeting is done, we will push fast-forward on this button,” Shepherd said. “We want them to be up and running on April 1.”

Shepherd told the council that realistically it will be closer to May or June before the new data center is up and running.

Who is the top prospect? DME won’t say and won’t reveal it before the contract is signed, DME spokesperson Stuart Birdseye said in an email Tuesday.

The Denton council’s direction comes at a time when Texas has become the No. 1 state for crypto mining companies to herd their data centers in Texas.

More than 30 are located in the Lone Star State, including five of the 10 biggest cryptocurrency mining companies in the U.S., according to a Jan. 3 report by The Texas Tribune.

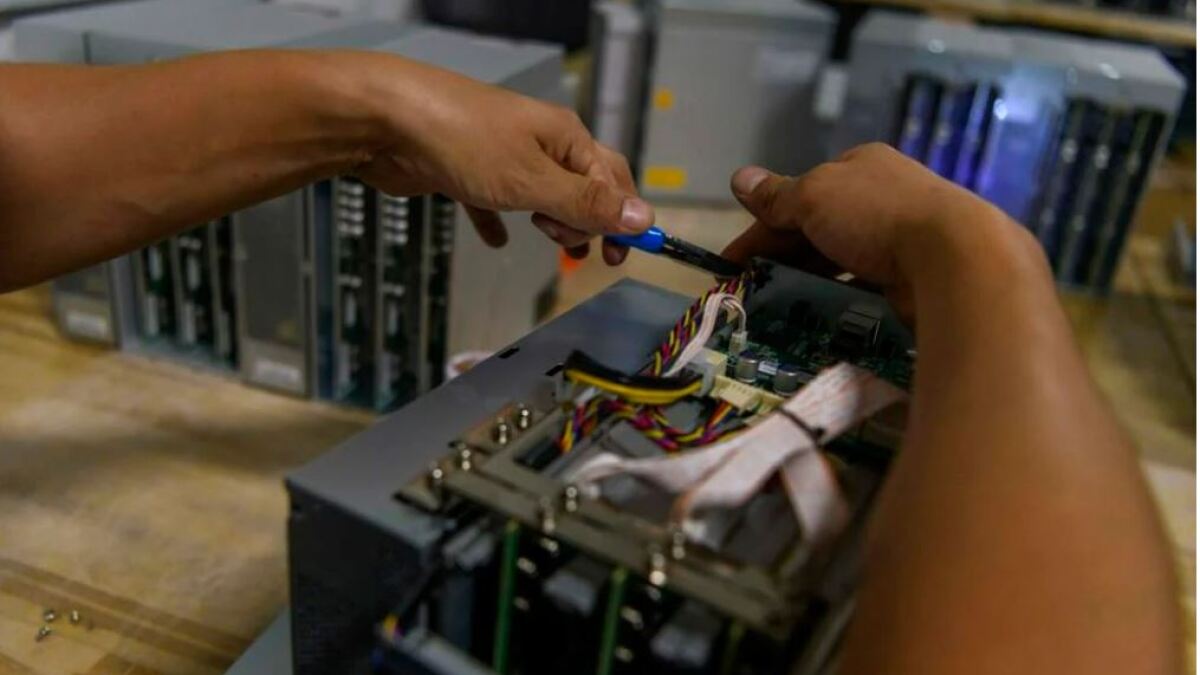

Cryptocurrency mining companies use high-speed computers to “mine” a digital coin worth tens of thousands of dollars.

As the Houston Chronicle wrote in a 2022 staff editorial, “These miners typically make quintillions — billions of billions — of guesses per second, generating so much heat from the computers that the warehouses employ enormous fans or air conditioning units to keep them cool. One energy research firm, Wood Mackenzie, estimates that the energy-intensive Bitcoin mining process raises electricity costs for Texans by $1.8 billion per year.”

Though cryptocurrency mining began about a decade ago in the U.S., recent growth is largely due to the mining operations relocating to the U.S. from China after Chinese officials cracked down on digital currency mining in 2021, according to a Feb. 1 report by the U.S. Energy Information Administration.

The EIA reported that this increase has led to several members of Congress sending letters in November 2022 and February 2023 to secure information that better identifies the effects of crypto mining on electricity and energy-related carbon dioxide emissions.

They also stressed the need for a “mandatory disclosure regime” regarding crypto miners’ emissions and energy use.

Grid planners, according to the EIA, are also expressing concern over the rapid growth in electricity demand associated with cryptocurrency mining. The North American Electric Reliability Corp. found that, for example, “due to unique characteristics of the operations associated with cryptocurrency mining, potential growth can have a significant effect on demand and resource projections as well as system operations.”

The EIA pointed out that the Electric Reliability Council of Texas has received 41 gigawatts of requests for new crypto mining capacity and has approved 9 gigawatts of planning studies.

A gigawatt of electricity is equal to 1 billion watts, or 10 million light bulbs.

In September 2022, the Sierra Club and Earthjustice, a nonprofit environmental law organization, released a guidebook, The Energy Bomb, to document the explosive growth of cryptocurrency mining in the U.S. and its impact. They found that from mid-2021 to mid-2022, crypto mining in the U.S. consumed as much electricity as four states combined and emitted 27.4 million tons of carbon dioxide. It is equivalent to the emissions from 6 million cars annually.

“Cryptocurrency mining is an extremely energy-intensive process that threatens the ability of governments across the globe to reduce our dependence on climate-warming fossil fuels,” according to the report.

Earthjustice couldn’t be reached for comment by Wednesday evening.

At the Tuesday work session, Hudspeth wondered if another new data center would face issues if bitcoin prices drop, similar to Core Scientific’s recent bankruptcy, which kept the company’s Denton facility from reaching full buildout on the timeline originally planned.

Terry Naulty, DME’s assistant general manager, told council that Core Scientific has been a success despite the bankruptcy in terms of net income for the Denton utility, job creation, revenues and tax base for the city.

Naulty said that the new data center is “virtually a riskless deal” due to the way it’s structured, which, he said, is the same way as Core Scientific’s deal with DME.

“I look at these transactions as only upside, no downside,” Naulty said.

Council member Paul Meltzer asked if the new data center would be competing for renewable energy and if more renewable energy would be coming online. He also inquired about how the new data center would work during peak usage moments.

How renewable energy works for cities is that all of the energy produced in Texas through solar, wind and gas feeds the grid, Birdseye said. At the end of the year, Birdseye said, DME buys renewable energy credits for all that energy that Denton consumed to make sure it’s 100% renewable.

Purchasing renewable energy credits signals to energy companies that more should be produced.

For example, natural gas and coal-fired power plants provided 69% of electric supply to the grid in 2018. Four years later, that number dropped to 60% due to green energy, according to a January report by the Houston Chronicle.

In his response to Meltzer, Naulty said Texas is the No. 1 producer of wind energy in the nation and soon will be the largest producer of solar energy in the nation as well. Over the next three years, Naulty said, ERCOT has interconnection agreements that will produce another 200 million megawatt-hours per year of additional renewable energy.

“This facility will use less than 1%, so there’s a lot more coming,” Naulty said.

Naulty compared the data centers to a battery because they curtail operations when electricity prices are high or there is high demand due to their power purchase agreement, which in turn frees up the energy they were consuming.

DME’s models project that the new data center will curtail its usage at about 700 megawatt-hours a year, Naulty said.

“If it’s a great emergency situation, we can curtail them,” Naulty said. “So we’ll purchase those renewable credits to offset what we expect it to be, either as we go through the year or at the end of the year, depending on when we can get them for the most value.”

Mandy DeRoche, deputy managing attorney in the clean energy program at Earthjustice, told The Texas Tribune that crypto miners shouldn’t be praised for curtailing energy usage when they use so much power from the grid.

“It’s like we’re bending over backward to give money to the [crypto] miner for putting the strain on the grid and the system in the first place,” DeRoche told The Texas Tribune.