Blockchain in Insurance Market

— Allied Market Research

NEW CASTLE, DELAWARE, UNITED STATES, January 30, 2024 /EINPresswire.com/ — Blockchain in insurance is a shared record-keeping technology in which the data is in cryptographically secured form. Blockchain technology enables data to be transferred in real-time between multiple parties in a trusted and verifiable manner while also bringing about considerable efficiency gains, cost savings, transparency, quicker pay-outs, and fraud reduction. The encrypted system that is utilized to secure digitalized data is referred to as the blockchain. It is used to digitally safeguard each financial transaction so that no one can tamper with it. Additionally, Blockchain can help new insurance methods create better markets and products. Moreover, the primary goal of blockchain in the insurance industry is to protect against fraud in automated transactions by allowing them to track and manage physical data digitally. Insurers and customers can use blockchain technology to create smart contracts that manage claims in a transparent and timely manner. Therefore, blockchain technology improves the efficiency of fraud detection & prevention and with the adoption of blockchain technology in insurance, the market is expected to grow in future. Moreover, the increasing demand for secure online platforms is being driven by several factors, including the growing use of digital technologies, rising concerns about privacy and data security, and the need for remote access to services. This is expected to boost the blockchain in insurance market size.

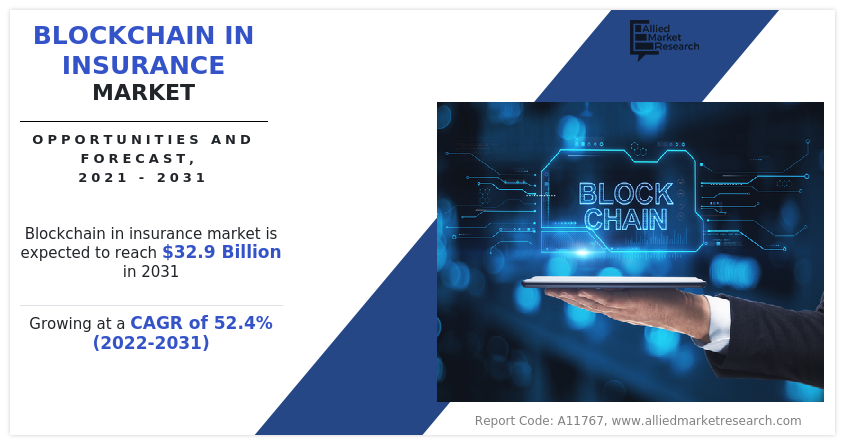

According to the report published by Allied Market Research, the global blockchain in insurance market generated $496.9 million in 2021, and is estimated to reach $32.9 billion by 2031, witnessing a CAGR of 52.4% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, key investment pockets, value chains, regional landscape, and competitive scenario. The report is a helpful source of information for leading market players, new entrants, investors, and stakeholders in devising strategies for the future and taking steps to strengthen their position in the market.

𝑹𝒆𝒒𝒖𝒆𝒔𝒕 𝑺𝒂𝒎𝒑𝒍𝒆 𝑪𝒐𝒑𝒚 𝒐𝒇 𝑹𝒆𝒑𝒐𝒓𝒕- https://www.alliedmarketresearch.com/request-sample/12132

Covid-19 Scenario:

The outbreak of the COVID-19 pandemic had a positive impact on the global blockchain in insurance market, as the pandemic highlighted the importance of trust and transparency in the insurance industry.

Moreover, the pandemic created new risks for the insurance industry, such as the risk of COVID-19-related claims. Blockchain technology helped insurers assess risk more accurately by analyzing data from various sources, including medical records, social media data, and other sources.

Furthermore, the pandemic emphasized the need for more efficient and cost-effective blockchain solutions in the insurance industry, resulting in increased use of blockchain and IoT-based services.

𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐘𝐨𝐮𝐫 𝐄𝐯𝐞𝐫𝐲 𝐃𝐨𝐮𝐛𝐭 𝐇𝐞𝐫𝐞: https://www.alliedmarketresearch.com/purchase-enquiry/12132

The report offers a detailed segmentation of the global blockchain in insurance market based on component, application, enterprise size, and region. The report provides an analysis of each segment and sub-segment with the help of tables and figures. This analysis helps market players, investors, and new entrants in determining the sub-segments to be tapped on to achieve growth in the coming years.

Based on component, the solution segment held the largest share in 2021, accounting for around two-thirds of the global blockchain in insurance market and would dominate the market in terms of revenue through 2031. The service segment on the other hand, is estimated to witness the fastest CAGR of 55.2% during the forecast period.

Based on application, the identity management and fraud detection segment captured the largest market share of more than one-third of the global blockchain in insurance market in 2021 and would maintain its leadership in terms of revenue in 2031. However, the payments segment is expected to achieve a fastest CAGR of 56.1% through 2031.

Based on enterprise size, the large enterprises segment held the largest share in 2021, accounting for more than two-thirds of the global blockchain in insurance market and would dominate the market in terms of revenue through 2031. On the other hand, the small and medium-sized enterprises segment is estimated to witness the fastest CAGR of 54.3% during the forecast period.

Based on region, the market in North America was the largest in 2021, accounting for nearly two-fifths of the global blockchain in insurance market. Furthermore, the market in Asia-Pacific would dominate the market in terms of revenue through 2031. Also, the same region is estimated to showcase the fastest CAGR of 57.6% from 2022 to 2031.

Leading players of the global blockchain in insurance market analyzed in the research include Amazon Web Services, Inc., Xceedance, IBM, Consensys, SafeShare Global, Microsoft, Oracle, Auxesis Services & Technologies (P) Ltd., RecordsKeeper, Symbiont.

The report analyzes these key players of the global blockchain in insurance market. These players have adopted various strategies such as expansion, new product launches, partnerships, and others to increase their market penetration and strengthen their position in the industry. The report is helpful in determining the business performance, operating segments, product portfolio, and developments by every market player.

Key benefits for stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the blockchain in insurance market analysis from 2021 to 2031 to identify the prevailing blockchain in insurance market share.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the blockchain in insurance market size segmentation assists to determine the prevailing blockchain in insurance market opportunity.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global blockchain in insurance market trends, key players, market segments, application areas, and market growth strategies.

𝑰𝒇 𝒚𝒐𝒖 𝒉𝒂𝒗𝒆 𝒂𝒏𝒚 𝒔𝒑𝒆𝒄𝒊𝒂𝒍 𝒓𝒆𝒒𝒖𝒊𝒓𝒆𝒎𝒆𝒏𝒕𝒔, 𝒑𝒍𝒆𝒂𝒔𝒆 𝒍𝒆𝒕 𝒖𝒔 𝒌𝒏𝒐𝒘: https://www.alliedmarketresearch.com/request-for-customization/12132

Blockchain in Insurance Market Key Segments:

Component

Solution

Service

Application

GRC Management

Claims Management

Identity Management and Fraud Detection

Payments

Others

Enterprise Size

Large Enterprises

Small and Medium-sized Enterprises

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

Top Trending Reports:

Remittance Market: https://www.alliedmarketresearch.com/remittance-market

Microfinance Market: https://www.alliedmarketresearch.com/microfinance-market-A06004

Employment Screening Services Market: https://www.alliedmarketresearch.com/employment-screening-services-market

Cryptocurrency Market: https://www.alliedmarketresearch.com/crypto-currency-market

Crop Insurance Market: https://www.alliedmarketresearch.com/crop-insurance-market-A06791

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports Insights” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int’l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

https://pooja-bfsi.blogspot.com/

https://steemit.com/@poojabfsi

https://medium.com/@psaraf568

David Correa

Allied Market Research

+ + 1 800-792-5285

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

![]()