I would like to ensure fellow Degens and Bitcoin Maxis that I am extremely Bullish on Bitcoin (BTC-USD). But nothing, even Bitcoin, goes up in a straight line. There are several ways of analyzing Bitcoin, and this article will focus mostly on OCTA, or on-chain-metrics. The current narratives of ETF fund flows and excitement over the April Halving event doesn’t guarantee a continuation of the Bitcoin chart’s green-candle. I’ve reassessed my view on the bullishness of the Halving – I no longer think it’s as important as the current narrative (read-on for details). Outside OTCA, other metrics are extremely bearish. For example, Sentiment is at giddy-levels – nothing good ever happens when everyone’s patting themselves on the back!

Introduction

You’ve probably heard of the Ides of March back when you were a schoolkid. Those immortal words were uttered in William Shakespeare’s Julius Caesar to the leader by a fortune-teller. I believe Bitcoin could finally witness its Caesarian-moment. Further, equity risk assets are also exhibiting signs of froth, so we have confluence. I believe that Bitcoin remains a risk asset despite its other narrative of being “digital gold.” Bitcoin’s safe-haven status remains a “show-me story” that will reveal itself during the next Black-Swan event.

On-Chain Technical Analysis (OCTA) aka On-Chain Metrics

One thing I’ve learnt the hard way is that one needs to utilize a consistent set of indicators, else you can become swayed with anecdotal news. I often recite this phrase as a reminder that information can sway us:

“There are 3 kinds of lies: lies, damned lies, and statistics” (source: Mark Twain)

The same goes for OCTA, so I keep a core set of charts that I understand and feel comfortable with. There is also a deep-flaw in these charts that reminds me of the issue of multicollinearity in regression. Essentially, a set of so-called “different” charts could simply be showing different angles of the same data. Below, I group a few on-chain-metrics by category to reduce this flaw:

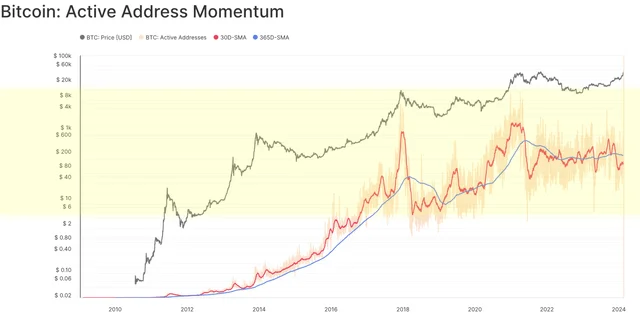

Usage Metrics (Active Addresses)

I was hesitant to show this chart as it’s longer-term compared to the others. You want the Red-line (30D moving average of addresses) to remain above the 365D MA. It’s ok if the long-term MA stays flat during Crypto Winter. However, what’s disturbing is that not only has it stayed flat in 2024, but the 30D MA (Red-line) has begun falling in the midst of a strong bull-run in Bitcoin that saw its price surge over 200% to around $69,000 (ATH).

Glassnode

Profitability charts (MVRV, NUPL, Value Days Destroyed, Realized Profit/Loss):

One way of measuring whether investors are going to sell is determining their MVRV. MVRV (Market Value to Realized Value) ratio is defined as an asset’s market capitalization divided by realized capitalization. It’s basically a ratio between Market Value and Cost-basis. The higher the MVRV or profits, the more likely you are to sell. The overall MVRV, around 2.8, is the highest level since the 2021 top in Bitcoin.

CryptoQuant

Another way of looking at this is by focusing on the NUPL (or Net Unrealized Profit or Loss). When the blue-line crosses the red horizontal line (at 92% as per the right axis) it signals a high-risk of investor selling. Think about it – the more money you make, the greater the urge to take profit and purchase that Ferrari. If one looks at the Realized Profit/Realized Loss ratio, the story is even worse with a ratio of 24.1 (meaning very high risk) as 95% of BTC is in profit.

Glassnode

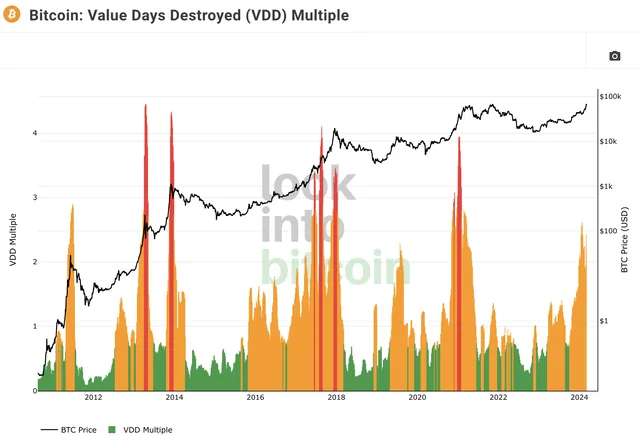

Value Days Destroyed (VDD)

The VDD is a lesser-known metric that highlights when older coins begin to rapidly enter the market to be sold. This typically happens when longer-term participants look to take profits as price accelerates up in major bull market cycles. Remember, smaller retail investors tend to buy and sell Bitcoin as the price rises and falls, respectively. Longer-term participants (and whales) tend to buy low-sell high.

Look Into Bitcoin

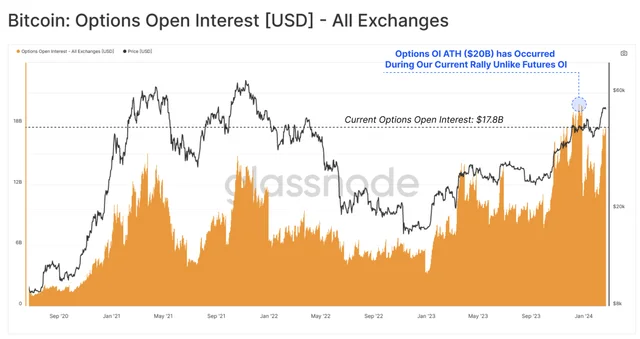

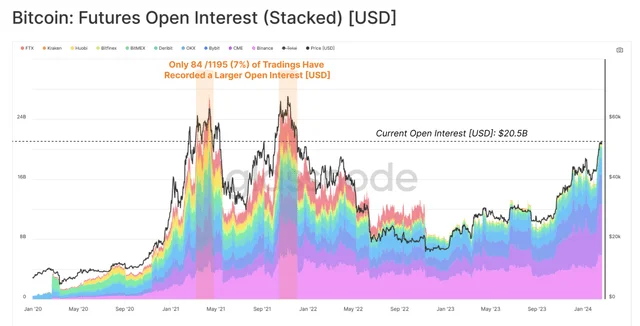

Derivatives markets (Options, Futures, Funding Rates)

There are a few ways of determining speculation in derivatives – we can look at Futures, Options, or implicit leverage related to liquid staking (out of this scope). When leverage or open-interest rises too quickly, this could portend high risk of cascading liquidations. I assume that rising open interest in either futures or options are mostly long positions, given human-nature. Though, we can also look at the Put/Call ratio as a clue here. The lower the ratio (the case today), the more speculators are sitting on the long-side of the sea-saw. Funding rates on perpetual futures also describe investor sentiment – at the current time, rates are high, meaning there’s much more demand to buy long BTC futures. (Open interest for options and futures are below.) Note that Options OI already hit an ATH, while Futures OI has not – this may be due to the FTX bankruptcy.)

Glassnode

Glassnode

Centralized Exchanges (Inflows, Outflows):

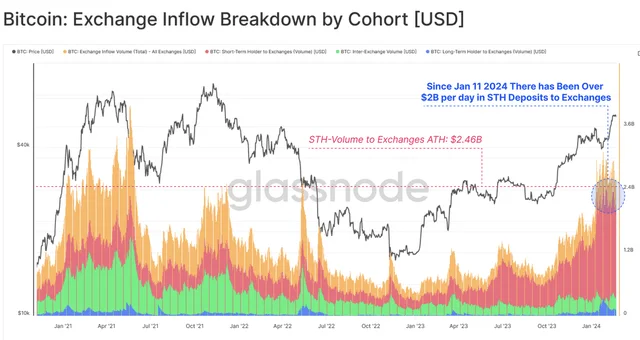

Typically, rising levels of Bitcoin on exchanges is a negative factor for price. This is because investors move Bitcoin from wallets to exchanges when they’re getting ready to sell. The current level of BTC on exchanges is particularly worrisome, given there had been a trend to permanently move away from centralized exchanges to DEXs after the FTX-Alameda fraud in late-2022. Furthermore, Glassnode noted that the huge majority of exchange inflows have been from short-term holders (red bars below), which they categorize as “speculative.” Rather than selling at the top, short-term holders (retail investors) are likely selling Bitcoin for more-speculative Altcoins.

Glassnode

Miner Activity

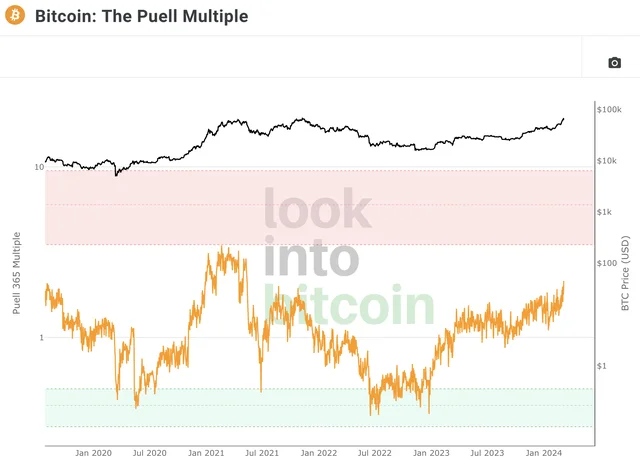

The Puell Multiple was invented by David Puell whose now at Ark Invest. This metric looks at the supply-side of Bitcoin’s economy. The Puell Multiple is calculated by dividing the daily issuance value of bitcoins (in USD) by the 365-day moving average of daily issuance value. Values above 2 are considered “bad” and near a local top. However, my confidence is this ratio is not high at the moment as I’m thinking that the heavy Miner selling is attributed to miners building-up their corporate treasuries before their returns are cut in half (via the April Halving.)

Look Into Bitcoin

Non-OCTA metrics (Whale selling, Sentiment, Monetary Policy):

There are other negative short-term factors, including the selling from Bitcoin whales. Of course, this excludes perma-bull Michael Saylor’s Microstrategy. However, I think that governments such as the U.S. (holds nearly 200k in confiscated Bitcoins) are selling their bags this year. Monetary policy remains tight, both in terms of global liquidity (i.e., central bank balance sheets) or the level of Fed Funds Rates. Jerome Powell continues to hammer “higher for longer” meaning the Fed won’t lower rates until they see hard evidence that inflation’s near its 2% target. If this is the case, the Bitcoin Halving may not go into full bloom until liquidity improves. In fact, if one back-tests Bitcoin and most other risk assets, you will notice they have been highly correlated with liquidity. The “strength” of Bitcoin after Halving events may merely be coincidental with the four-year liquidity cycle. Nothing more – nothing less.

Sentiment remains giddy in corporate bonds (as represented by narrow yield spreads), equities and crypto. Within crypto, the largest gainers aren’t the ones with the best fundamentals – instead the biggest gains are represented by variations of dogs named Bonk, Shiba Inu, Dogwifhat and Dogecoin. These speculations typically portend a short-term peak in crypto. The contrarian Fear & Greed Index is flashing “Extreme Greed.”

Alternative.me

Closing Remarks:

Markets don’t go straight up, and neither should your expectations. However, the long-term case for Bitcoin is stronger than ever. There are 16MM coins being HODLed for dear life (including 3MM lost coins) and just 21MM in total max-supply. Miners aren’t producing enough to quench the never-ending demand from Spot ETFs, resulting in a chronic shortage. As Economics 101 would dictate: “less supply + rising demand = Moon.”

There will be a long-tail of constant flows into ETFs given that a great deal of AUM (Assets Under Management) is held under asset managers with slower execution-times (e.g., pensions, endowments). While your friend may have bought Bitcoin’s spot ETF on opening day, a typical pension fund needs to go through several hoops to change its asset allocations – and those allocations typically take years to play out.

So, as William Shakespeare may have said, “Caveat Emptor.”