Table of Contents

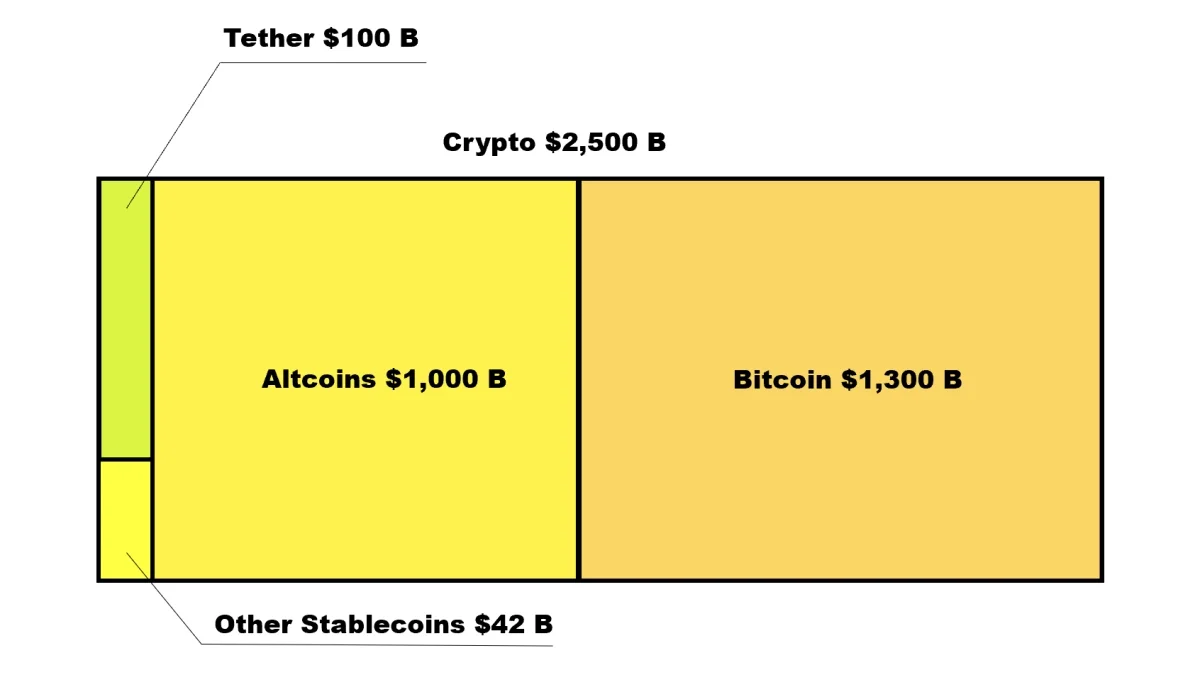

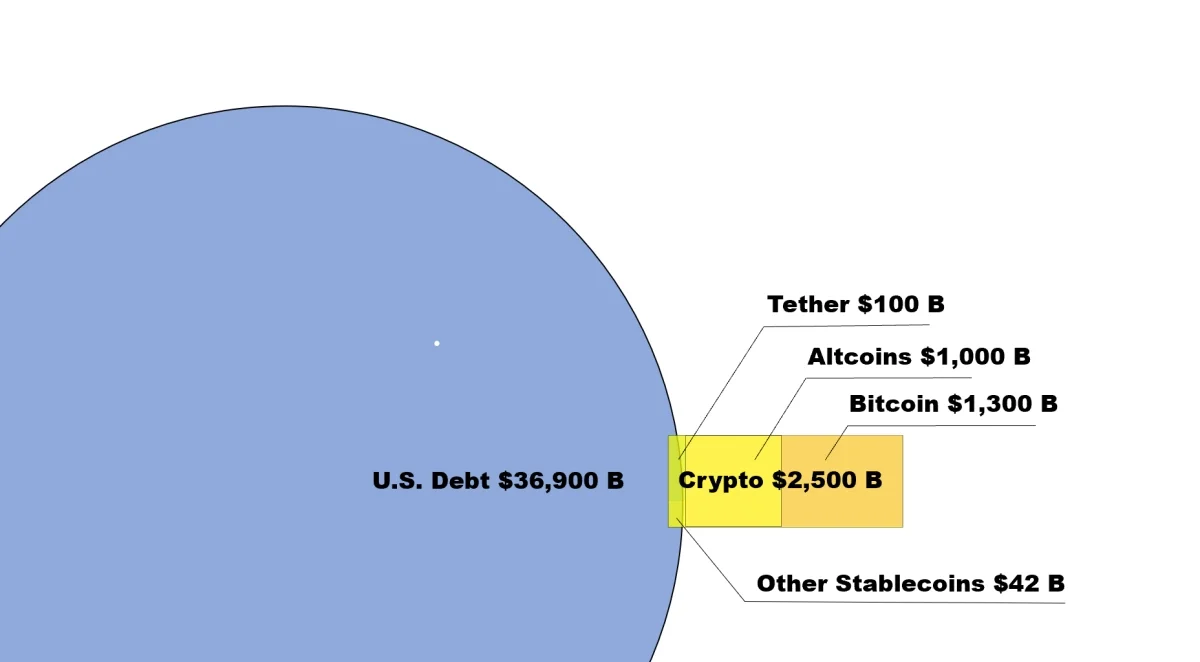

The largest USD-pegged stablecoin has reached a capitalization of $100 billion. Let’s put this number in perspective:

Blockchain’s “Killer use case”

USDT is, first and foremost, a blockchain product. Launched in 2014, it has weathered two crypto winters and the collapses of both Terra/Luna and FTX. It serves as a bridge between currencies on centralized exchanges and effectively bridges various blockchains without using the legacy banking system. As a crypto project it is only topped by Bitcoin and Ethereum in terms of significance and holds a substantial 70% share of its stablecoin segment

New money on the Block

Tether’s USDT is money. When comparing its circulating volume to the monetary supply parameter, M2, of national currency issuers, its position lies somewhere in the middle, above such countries as Bulgaria, Kazakhstan and Argentina.

FinTech company Tether

Unlike Circle’s USDC, which is mainly used in cryptoexchanges and DeFi, Tether also has a significant penetration outside of the crypto world. It is widely used as a remittance and payment instrument, and as a savings tool for people in countries with underdeveloped banking infrastructures and unstable domestic currency. During the most recent crypto winter following the Terra/Luna crisis, USDT volumes did not follow the pattern of overall crypto market cap, instead growing independently due to non-trading usage.

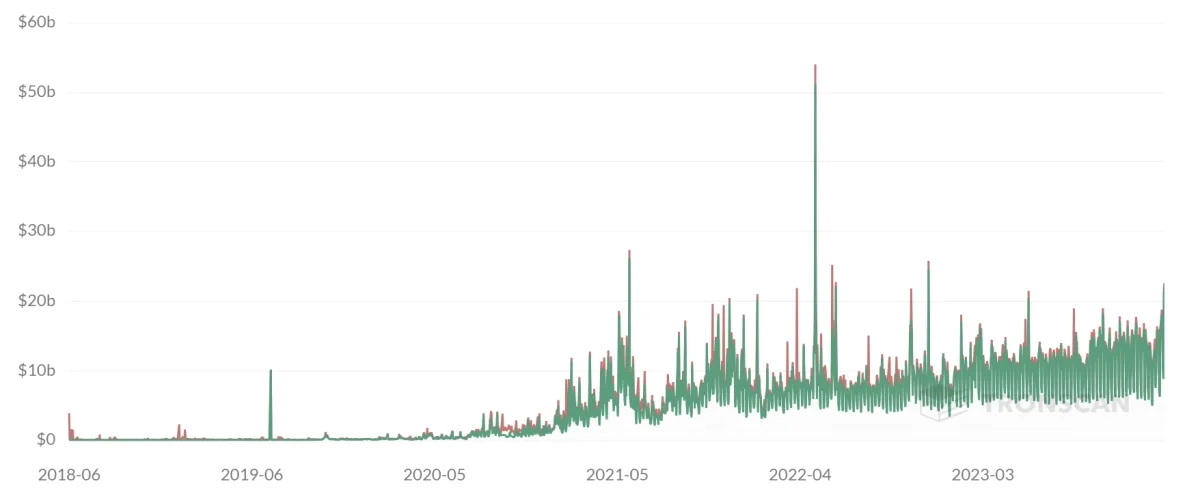

Looking at the graph above, we can assume that between 20 and 40 billion USDT is serving purposes other than cryptocurrency trading. This is comparable with the average level of client funds on PayPal’s books. The profits reported by Tether (around $1.5 Billion per quarter) are also in line with PayPal’s profits. However, PayPal primarily makes its profit from commission revenues, while Tether earns on its reserves and, presumably, on trading.

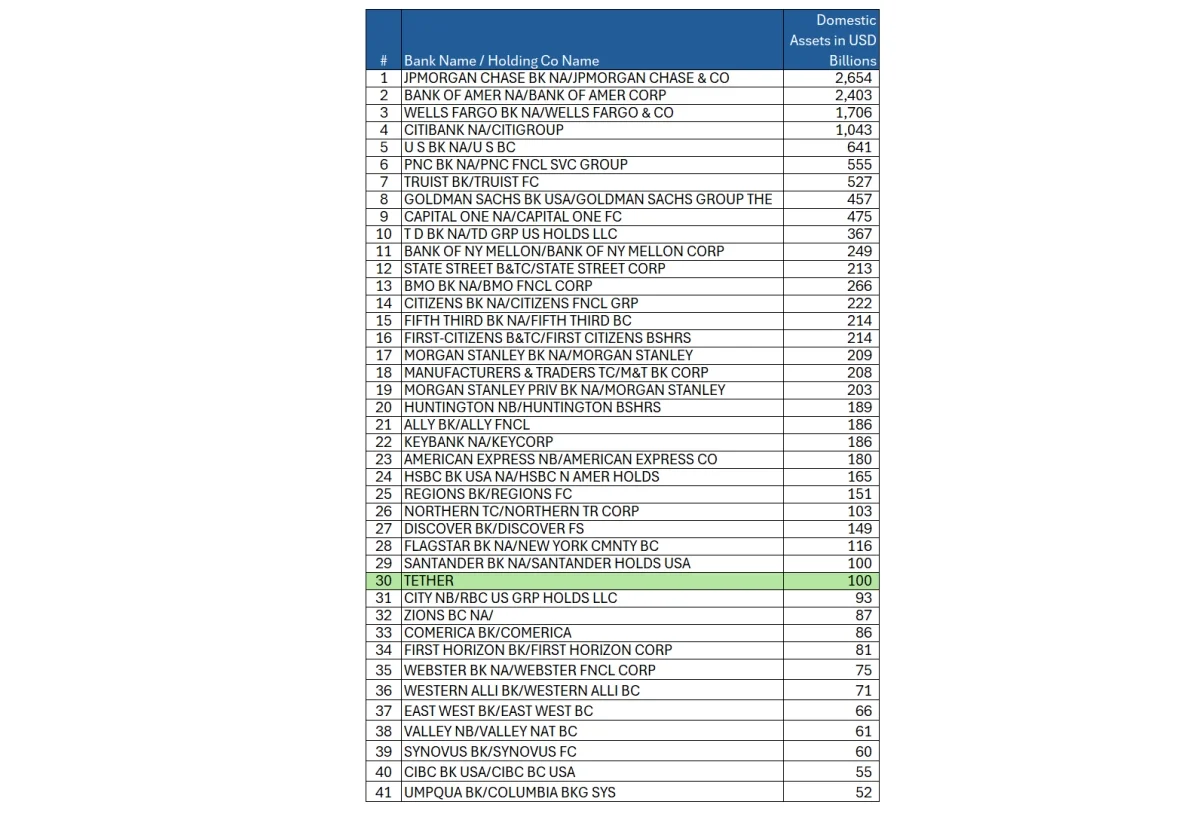

Tether Bank

The balance sheet of Tether looks very much like that of a deposit-taking financial institution. It does not pay interest on deposits, yet in modern banking history this is not unusual, and there have even been cases where clients were ready to pay a fee to park their money.

Tether is also a large investor in U.S. Treasury bonds. Since 2021, the company has started actively rearranging its reserve investment portfolio and now keeps around 60% in U.S. Treasury bills with short-term maturity. Compared to the total U.S. debt, it holds only a tiny share, yet this already puts Tether in the top 20 foreign holders of U.S. debt, between such countries as Australia and Mexico.

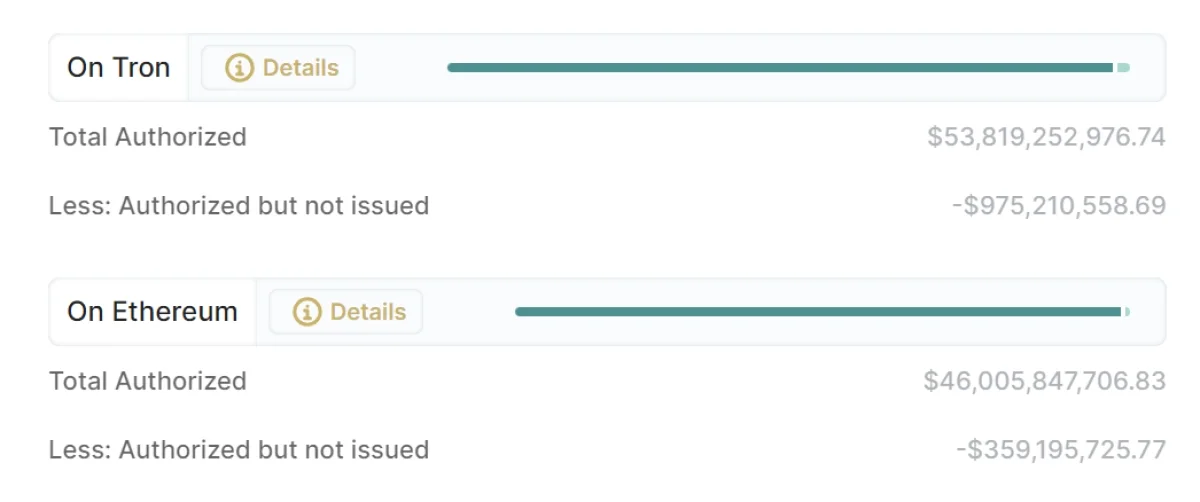

Tether on Tron

It is also interesting to Observe the preferred choice of blockchain rails for Tether.

More than half of the circulating USDT tokens are deployed on Justin Sun’s Tron blockchain. Tether is notably the only major client of this project, making virtually 99% of its transaction volume.

Tether’s position on Tron is even more unchallenged since closest rival, Circle, recently discontinued its support for the network, for rather unclear reasons. Officially, Circle cited security and compliance issues, yet it continues to operate on various other blockchains including Algorand, Arbitrum, Avalanche, Celo, Flow, Hedera, NEAR, Noble, OP Mainnet, Polkadot, Polygon PoS, Solana, and Stellar.

Perhaps Tron is not the most secure and decentralized platform, but it is cheap and fast. Addressing concerns about blockchain resilience, Tether recently posted that it had “established an official recovery tool that can migrate USDT between blockchains.”

So ultimately, what is Tether’s USDT? A new form of money, a crypto project, a FinTech, or a bank? Per our observations, its leadership doesn’t feel the need to define it in such terms. So far it is doing the job pretty well.

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.