While the

spotlight often falls on Asia and North America when discussing cryptocurrency

adoption, Western Europe has been making significant strides in embracing

digital assets.

In a recent

report, Bitget Research has shed light on European countries’ crucial role in the global cryptocurrency market. The region, known for its developed

economies and open-minded populace, has emerged as a key player in the crypto

industry, with daily trading participants ranging from 1.2 million to 1.5

million.

Among the

eight Western European countries studied, Germany and France stand out as the

most active hubs for cryptocurrency activities. According to the report, these

two nations have seen significant growth in the number of users engaging with

digital assets. Western Europe as a whole is the world’s second-largest region in terms of crypto adoption.

“Observations

of traffic to domains of more than 150 centralized cryptocurrency exchanges

show that, over the past six months, the total visit volume from Germany and

France was 48.17 million and 35.11 million, respectively, with the Netherlands

ranking third with 30 million visits,” the Bitget’s report stated.

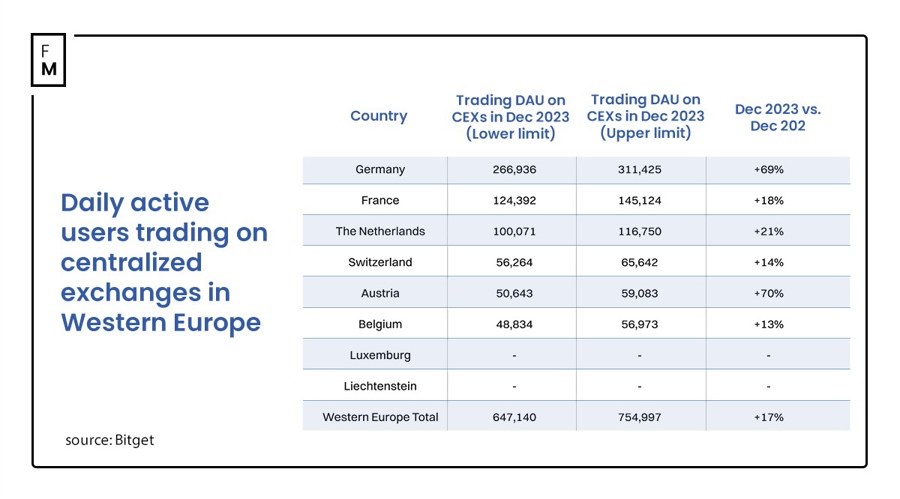

The number

of active daily users on centralized cryptocurrency exchanges in Germany was

311,000 in December 2023, marking an improvement of 69% compared to December 2022. In

France, there were 145,000 active users, which is an increase of 18% from the

previous year. At 70%, the strongest growth was recorded in Austria, where the

activity index reached nearly 60,000 investors daily over the year.

The growing

interest in cryptocurrencies is also evident from the data of the report’s

author, Bitget Exchange. Its user base has increased to 25 million as of the

end of February 2024, having grown by 5 million in just under three months.

Regulatory Alignment and

Cultural Acceptance

The report

highlighted that the crypto policies in Western European countries generally

align with the European Union’s stance and the MiCA regulations, maintaining an

open attitude towards cryptocurrency regulation while providing a stable and

transparent regulatory environment.

The report added that on top of Germany, France, and the Netherlands, “Switzerland, Belgium, Austria, Luxembourg, and Liechtenstein have relatively open policies on cryptocurrencies and blockchain technology, offering a stable and transparent regulatory environment.”

From a

cultural perspective, Western Europeans have remarkably accepted blockchain technology and cryptocurrencies. The region’s history of embracing

innovation and new ideas has translated into a willingness to explore the

potential of digital assets.

Chain Preferences and

Trading Habits

Western

European users have demonstrated a strong affinity for decentralized projects,

showcasing their familiarity with decentralized exchanges (DEXs) and other

on-chain tools. The report has revealed that users in this region prefer popular

chains and the Solana ecosystem.

Regarding trading preferences, spot trading remains the most favored option

among Western European users. However, countries like Germany, the Netherlands,

and Switzerland have shown a stronger inclination towards futures trading. The

report also noted a high level of acceptance for emerging assets, such as

non-fungible tokens and meme coins.

These instruments have driven the volumes of cryptocurrency exchanges at the beginning of 2024, including in February when trading activity grew for the

fifth consecutive month.

Centralized Exchanges

Dominate, but DEXs Gain Traction

Centralized

exchanges continue to be the primary choice for cryptocurrency trading in

Western Europe, with traffic to these platforms showing a fluctuating upward

trend over the past year. This indicates a higher demand among Western European

users for centralized exchanges than their decentralized counterparts.

“In terms of competitive landscape and platform advantages, global centralized exchanges continue to dominate the market with a more diverse and comprehensive range of services,” Bitget added.

However,

the report also highlighted the growing popularity of leading decentralized

exchanges across various chains, such as Uniswap and Pancakeswap. Western

European users primarily utilize these DEXs and popular wallets like

TrustWallet, Metamask, Coinbase Wallet, and Bitget Wallet.

As the

cryptocurrency industry continues to evolve, Western Europe is poised to remain

a driving force, shaping the future of digital assets and blockchain

technology.

While the

spotlight often falls on Asia and North America when discussing cryptocurrency

adoption, Western Europe has been making significant strides in embracing

digital assets.

In a recent

report, Bitget Research has shed light on European countries’ crucial role in the global cryptocurrency market. The region, known for its developed

economies and open-minded populace, has emerged as a key player in the crypto

industry, with daily trading participants ranging from 1.2 million to 1.5

million.

Among the

eight Western European countries studied, Germany and France stand out as the

most active hubs for cryptocurrency activities. According to the report, these

two nations have seen significant growth in the number of users engaging with

digital assets. Western Europe as a whole is the world’s second-largest region in terms of crypto adoption.

“Observations

of traffic to domains of more than 150 centralized cryptocurrency exchanges

show that, over the past six months, the total visit volume from Germany and

France was 48.17 million and 35.11 million, respectively, with the Netherlands

ranking third with 30 million visits,” the Bitget’s report stated.

The number

of active daily users on centralized cryptocurrency exchanges in Germany was

311,000 in December 2023, marking an improvement of 69% compared to December 2022. In

France, there were 145,000 active users, which is an increase of 18% from the

previous year. At 70%, the strongest growth was recorded in Austria, where the

activity index reached nearly 60,000 investors daily over the year.

The growing

interest in cryptocurrencies is also evident from the data of the report’s

author, Bitget Exchange. Its user base has increased to 25 million as of the

end of February 2024, having grown by 5 million in just under three months.

Regulatory Alignment and

Cultural Acceptance

The report

highlighted that the crypto policies in Western European countries generally

align with the European Union’s stance and the MiCA regulations, maintaining an

open attitude towards cryptocurrency regulation while providing a stable and

transparent regulatory environment.

The report added that on top of Germany, France, and the Netherlands, “Switzerland, Belgium, Austria, Luxembourg, and Liechtenstein have relatively open policies on cryptocurrencies and blockchain technology, offering a stable and transparent regulatory environment.”

From a

cultural perspective, Western Europeans have remarkably accepted blockchain technology and cryptocurrencies. The region’s history of embracing

innovation and new ideas has translated into a willingness to explore the

potential of digital assets.

Chain Preferences and

Trading Habits

Western

European users have demonstrated a strong affinity for decentralized projects,

showcasing their familiarity with decentralized exchanges (DEXs) and other

on-chain tools. The report has revealed that users in this region prefer popular

chains and the Solana ecosystem.

Regarding trading preferences, spot trading remains the most favored option

among Western European users. However, countries like Germany, the Netherlands,

and Switzerland have shown a stronger inclination towards futures trading. The

report also noted a high level of acceptance for emerging assets, such as

non-fungible tokens and meme coins.

These instruments have driven the volumes of cryptocurrency exchanges at the beginning of 2024, including in February when trading activity grew for the

fifth consecutive month.

Centralized Exchanges

Dominate, but DEXs Gain Traction

Centralized

exchanges continue to be the primary choice for cryptocurrency trading in

Western Europe, with traffic to these platforms showing a fluctuating upward

trend over the past year. This indicates a higher demand among Western European

users for centralized exchanges than their decentralized counterparts.

“In terms of competitive landscape and platform advantages, global centralized exchanges continue to dominate the market with a more diverse and comprehensive range of services,” Bitget added.

However,

the report also highlighted the growing popularity of leading decentralized

exchanges across various chains, such as Uniswap and Pancakeswap. Western

European users primarily utilize these DEXs and popular wallets like

TrustWallet, Metamask, Coinbase Wallet, and Bitget Wallet.

As the

cryptocurrency industry continues to evolve, Western Europe is poised to remain

a driving force, shaping the future of digital assets and blockchain

technology.