Story Highlights

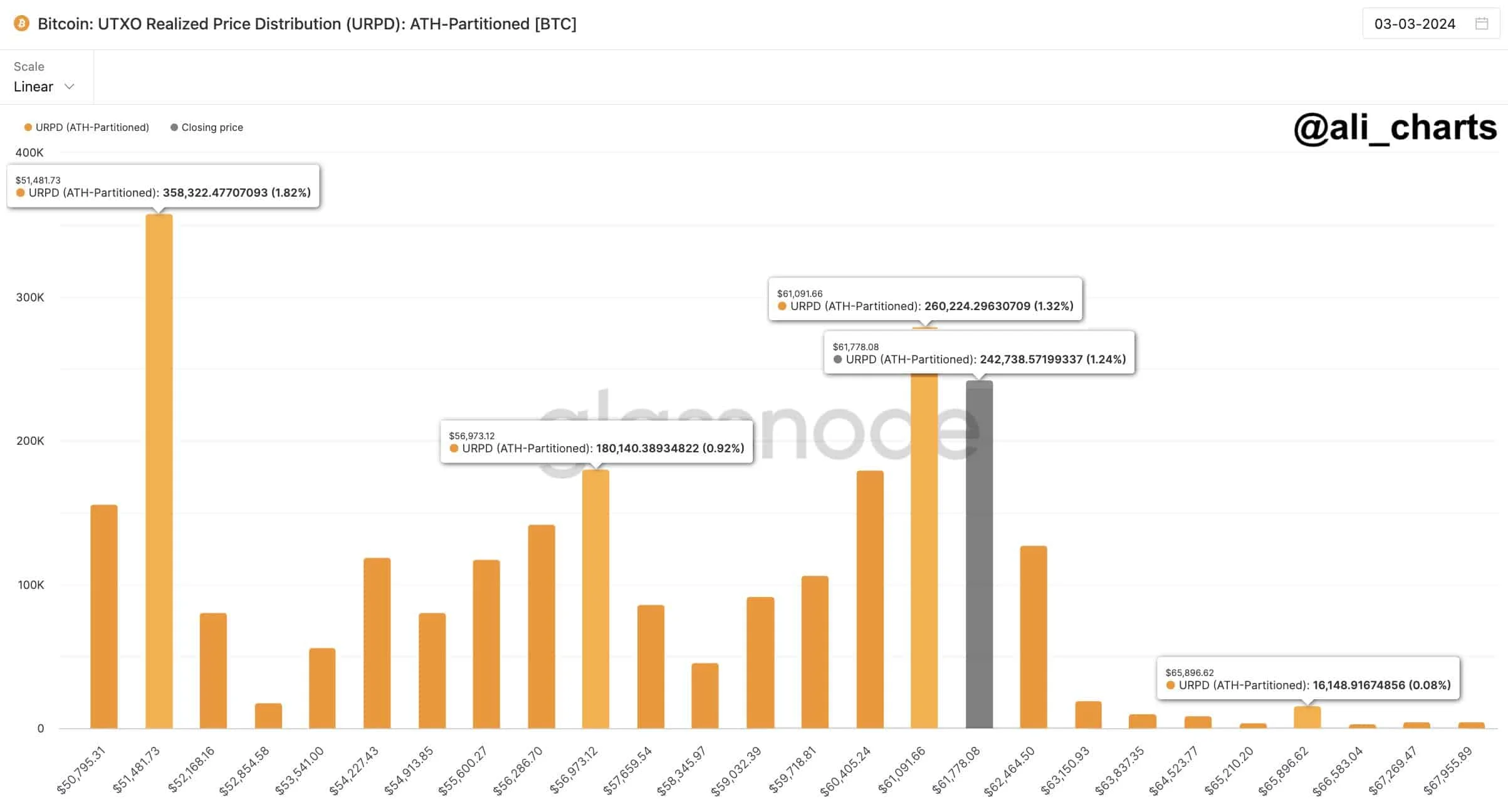

- $61,100 to $61,800, serves as the key support area for Bitcoin due to massive transaction.

- If Bitcoin fails to hold this support, the BTC price could slip to $56,970 or even $51,500.

- Bitcoin ETF inflows continue strong with BlackRock leading the show.

On Sunday, March 3, the world’s cryptocurrency Bitcoin (BTC) surged past $64,000 once again, however, faced rejection again above those levels. At press time, the Bitcoin price is up 2.80% trading at $63.790 with a market cap of $1.253 billion. As per the CoinGlass data, the total Bitcoin liquidation data has surged to $440,000 in the last 24 hours.

Key Bitcoin (BTC) Price Levels to Watch

According to insights shared by renowned crypto analyst Ali Martinez, the Bitcoin (BTC) market has witnessed significant activity in a specific price range. Martinez notes that over 500,000 BTC have been transacted within the range of $61,100 to $61,800, establishing a substantial support area for the cryptocurrency.

He further suggests that if Bitcoin manages to sustain its position above this support threshold, it is likely to continue its upward trajectory towards $65,900, with minimal resistance anticipated ahead.

However, Martinez also highlights the potential downside risks for BTC. Should Bitcoin falter and dip below the established support level, a correction could ensue, potentially driving the price down to $56,970 or even $51,500.

BTC Price At $125,000

Bitcoin analyst Will Woo has offered an optimistic projection for the price of Bitcoin (BTC), predicting that it could surpass $125,000 before the end of 2025 on a conservative basis. Woo’s analysis hinges on the assumption that clients of investment giants Blackrock and Fidelity will allocate a modest 3% of their portfolios to Bitcoin.

According to Woo’s calculations, if Blackrock, with assets totaling $9.1 trillion, were to allocate 84.9% of this amount to Bitcoin, and Fidelity, with $4.2 trillion in assets, were to allocate 3%, the resulting investment would significantly impact Bitcoin’s price trajectory.

Despite these allocations representing just a fraction of the total global wealth, estimated at around $500 trillion, Woo believes that the endorsement from major asset managers like Blackrock and Fidelity could drive substantial inflows into Bitcoin, leading to significant price appreciation.

Massive Bitcoin ETF inflows have rocked Satoshi Street over the last two months. BlackRock Inc.’s iShares Bitcoin Trust (IBIT) and Fidelity Investments’ Wise Origin Bitcoin Fund (FBTC) have collectively garnered 79% of total inflows among the “Newborn Nine” funds. In response, four of the remaining seven funds have opted to reduce their fees below those of the two leading funds.