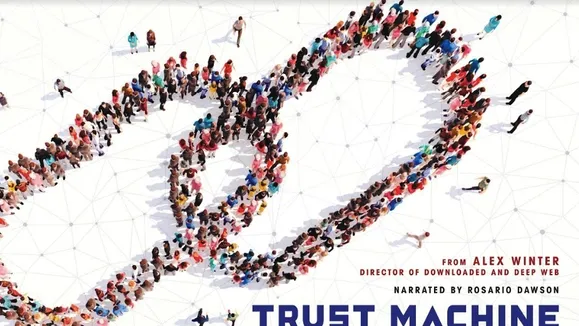

As blockchain technology redefines financial landscapes, the conversation pivots back to its foundational promise of trust without intermediaries. Amidst this digital renaissance, a historical figure from 15th-century Venice, Friar Luca Pacioli, emerges as an unlikely yet pivotal character in understanding blockchain’s potential. Pacioli, known for inventing double-entry bookkeeping, revolutionized finance in ways that echo today’s blockchain aspirations. This backdrop sets the stage for exploring whether blockchain can indeed fulfill its promise as a ‘trust machine’ or if regulatory hurdles present significant challenges.

From Renaissance to Digital Revolution

The principles of double-entry bookkeeping, introduced by Pacioli, laid the groundwork for modern financial systems, emphasizing accuracy, fraud prevention, and economic efficiency. Fast forward to 2009, when Satoshi Nakamoto proposed bitcoin and blockchain as means to circumvent traditional financial intermediaries, ensuring secure, effortless transactions. Yet, the journey from conception to global adoption of blockchain technology underscores a critical vetting process concerning its competence, value, and safety. Despite its potential, blockchain’s path is marred by skepticism, stemming from past industry implosions and ongoing regulatory debates.

Blockchain’s Utility and Challenges

The transformative capabilities of blockchain extend beyond financial transactions, offering solutions for corruption-resistant humanitarian aid, cost-effective cross-border payments, and secure data management, among others. However, the technology’s promise is continuously tested against safety concerns and regulatory scrutiny. The irony that a technology designed to operate beyond governmental oversight now faces the prospect of stringent regulations reflects a crucial pivot point. The anticipated establishment of comprehensive regulatory frameworks in jurisdictions like Japan, Hong Kong, Singapore, and potentially the US, could herald a new era of blockchain acceptance and trust.

Navigating the Future Landscape

As blockchain technology evolves, its potential to modernize and democratize financial infrastructure becomes increasingly apparent. The critical question remains whether it can transition from a novel concept to a trusted, regulatory-compliant platform. The impending regulatory developments will play a pivotal role in shaping blockchain’s future, influencing public confidence and its application across various sectors. Amidst these changes, the principles of trust, utility, and safety that guided Pacioli’s innovations continue to serve as beacons for evaluating blockchain’s role in the next phase of financial evolution.

The year ahead promises to be a watershed moment for blockchain technology, potentially cementing its status as a genuine ‘trust machine.’ As we stand at the crossroads of historical innovation and future possibilities, the ongoing dialogue between technology enthusiasts and regulators will likely determine the trajectory of blockchain’s integration into the global financial system. The journey from Pacioli’s ledgers to blockchain’s distributed ledgers signifies more than a technological leap; it represents the continuous quest for systems that foster trust, efficiency, and inclusivity in economic activities.